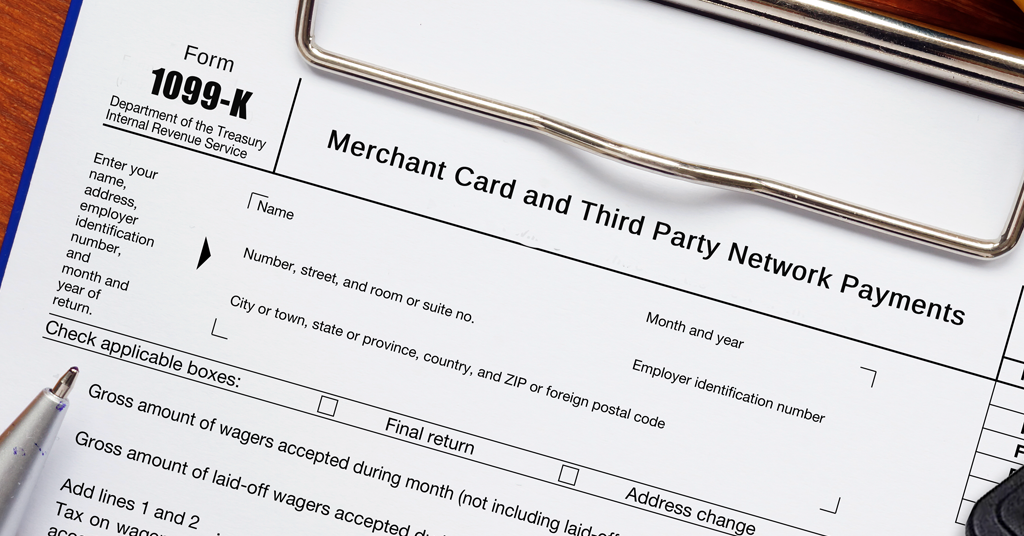

Big news for anyone dealing with third-party platform payments: The IRS has announced a delay in implementing the new $600 Form 1099-K reporting threshold for 2023. Instead, they plan to phase in a higher threshold of $5,000 starting in 2024. This follows the decision to maintain the existing $20,000/200 transaction threshold for the 2022 tax year, which will now continue through 2023 as well.