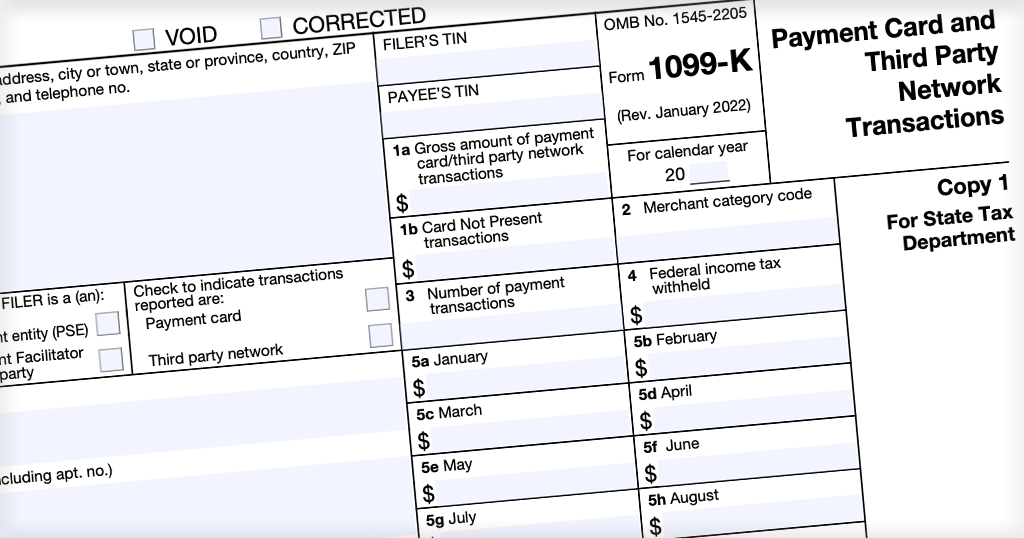

Before 2022, the IRS required marketplaces to issue Form 1099-K when sellers reached 200 transactions and $20,000 in gross payments in a year. However, starting January 1, 2022, the minimum number of transactions was removed, and the threshold was changed to $600. Many more 1099-K will be issued this year, and eBay is trying to help sellers understand the Form 1099-K tax obligations by partnering with TaxAct.

This means you should receive your 1099-K from marketplaces if you exceeded the gross payments totaling $600, no matter how many items you sold.